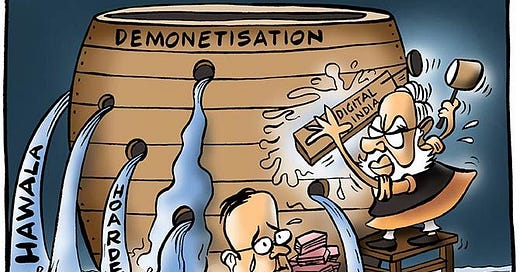

Demonetization is a terrible idea

Shabbar Zaidi is pushing cuckoo economics that would have devastating consequences for Pakistan's economy.

Ever since he came on Twitter, Shabbar Zaidi has been pushing one crazy idea after another. The most recent one is with regards to declaring Rs. 5,000 notes as illegal tender, which is basically a “soft” version of the demonetization we saw in India.

Before I share my opinion on this, here is some data from a Business Recorder article published on February 3, 2021:

The ratio of CIC to M2 (broad money) on average was 23 percent (FY01-FY06) six years prior to introduction of Rs5,000 and the ratio was 22 percent (FY07-12) six years after it. In fact, the ratio fell after the Rs5,000 note was introduced in May 2006. The ratio was 23 percent in June 2015. In July 2016, the banking transaction tax was imposed and the government efforts to discriminate between filers and non-filers in terms of taxation were expedited. The ratio increased to 26 percent by June 2016. This means markets reacted to the government efforts and transactions sped up in the informal sector. The ratio started inching up since then and reached 28 percent by June 2019. Then Shabbar came and new efforts to curb undocumentation were introduced – the ratio increased to 29 percent by June 2020 – some role has been played by COVID in this – visible from Indian data too.

Basically, the data shows that 5,000 rupee notes have had no direct and visible impact on the amount of cash in circulation in the economy.

Across the border, the Modi government tried a similar move to combat corruption, something with Mr. Zaidi also wants to combat in Pakistan. This is what Modi said to justify his move:

To break the grip of corruption and black money, we have decided that the five hundred rupee and thousand rupee currency notes presently in use will no longer be legal tender from midnight tonight, that is 8th November 2016. This means that these notes will not be acceptable for transactions from midnight onwards. The five hundred and thousand rupee notes hoarded by anti-national and anti-social elements will become just worthless pieces of paper. The rights and the interests of honest, hard-working people will be fully protected.

But it did not have the intended effect, and over 99 percent of the currency declared as illegal tender coming back into the banking system. In fact, the country’s chief economic adviser at the time, Arvind Subramanian, later called it a “massive, draconian, monetary shock.”

Prime Minister Khan, do not listen to Mr. Zaidi.

What Mr. Zaidi is pushing is going to have a terrible impact on Pakistan’s economy, particularly the informal part of it. Dr. M. Ali Kemal, who I have interviewed on the podcast, has written a research paper estimating the size of the informal economy, which is roughly 40 percent of the country’s GDP.

This informal economy, argues Dr. Kemal, exists not because of just corruption and criminal activity. It exists because of a high burden of taxes, high level of regulation, poor public services, and a lack of trust in institutions.

In short, people run away from documentation because they do not have any incentives to be a part of the formal economy. Rather than providing incentives and improving service delivery to reinforce the social contract and incentivize formalization, folks like Mr. Zaidi want to use more sticks on the country’s citizens.

This will not work. In fact, if such a move were to occur, we will quickly see economic activity come to a grinding halt, potentially ushering in yet another recession that leads to loss of jobs and incomes for millions of citizens.

I present the largest money laundering operation in the world sponsored by a state

The Indian Notebandi.It is the disaster of the Brain of Narendra Modi !

The Demo Scam – which no Indian Newspaper reported – as they were all paid off – as they are of the ilk of the Brahmins and Banias.dindooohindoo

Part 1

Conversion Route (Elementary Level – rest to be submitted at the CIC Hearing)

• Party A has Rs 1 crore of Old Cash (which is obviously unaccounted) and the choice of paying tax and interest thereon has lapsed as there is no VDIS – and post Demo the deemed tax is 100% at the minimum

• Party B (Stage 1 Converter) has Rs 65 lacs of New Cash – which is given to Party A in lieu of the Old Cash of Rs 1 crores which is then given to Party C to X as under:

o Party C to X (Stage 2 Converter) are legal entities who trade in Nil VAT/ST products (or under Exemptions and /or Compounding) and are POS Retailers who then , make manual or backdated E-Bills for fictitious sales of items to unknown individuals and deposit the new cash into the bank

o Party C to X deposit the cash in banks whose books are open for 30-45 days before the date of announcement of the Demo or whose IT systems allow backdating of E- Bank Statements (within the period of reporting to the RBI and other Regulators)

• Party Z then taps Party A to convert the New cash Received of Rs 70 lacs into a capital entry to clean the cash at a rate of , say 15%, wiring Rs 59 Lacs to Party A, as a capital receipt etc, and taking the Rs 70 lacs of new cash from Party A

• Party Z which is basically front for Party B – hands the cash to Party B, after charing the custodial, logistics and security charges

• Party B then resumes the same chain as in Step 2 above, wherein the rate of the conversion, id.est., 30% keeps rising as the DEMO deadline appears

• Party A can convert the Rs 50 lacs into cash – new and old – at a premium, at any time that it is required

Notes

• Since converters had the new cash within a day and as per news reports , even before the announcement of Demo, they have to be part of the establishment

o If the converters had withdrawn the new notes from the bank, the banks would have tipped off the DRI/ED etc and possibly reported to the RBI – in which case they would be raided (but were not) or they would have to explain why large amounts of cash were withdrawn (for labour wages – although wages are not paid in Rs 2000 notes , agri payments etc) and on specific dates and how/why the banks were satisfied about the same

o Hence, if the converters got the new cash o/s the Banking system – that is fraud and PROOF THAT THE CONVERTERS ARE PART OF THE ESTABLISHMENT

o If the converters got the new cash from the banks – it is proof of collusion and fraud by the bankers, as past patterns of withdrawal by bank customers (for labour, wages, agri payments etc), would not support the new notes withdrawal

• Since converters had TO TRANSPORT CASH ACROSS LOCATIONS, IT WOULD HAVE REQUIRED SECURITY OR PERHAPS STATE SECURITY, they have to be part of the establishment as

o It is impossible that the state would not be aware of the logistics and security

o It is impossible that the state would not raid the cash movement

• Since Party C to X, who would have reported drastic increase in cash sales and deposit of cash into the bank , would not be able to support the same by PAST PATTERNS OF RAW MATERIAL PURCHASES AND TRADING PURCHASES AND SUCH LARGE AMOUNTS OF PURCHASES OF RAW MATERIALS IN CASH – COULD NOT HAVE BEEN JUSTIFIED BY PARTY C TO X , W/O THE SUPPORT OF THE ESTABLISHMENT

• Cash recovered in the “form of old notes” by the “DRI/ED and the Police” – were all recovered from the “so called originators” and “so called garbage dumps”- w/o “a single case of cash recovered” from “the converters/entry operators”

• No cash was recovered from the “converters/entry operators (Party B and Party C to X, as stated above)”, who are obviously part of the establishment – which is unusual , as the operators would be having the new currency which o Is either kept in a house/safe or o Stocked in the bank (which would have tipped off the DRI/ED etc or o Transferred the cash around in new stocking points and neither of the 2 above points can happen w/o the support of the establishment

• Since the GDP is still growing on the “computation mode of GDP on expenditure mode”, and there is “no shortage of notes” of less than Rs 100,it would mean that the Industrial agglomerations typified by the SSI and the Cash sector,have been “able to convert the bank deposits”, back into cash – “obviating the purpose” of the notebandi (Rs 100 is assumed,as the wages are paid in that denomination

The Entire INDIAN DEMO EXERCISE WAS A GIGANTIC FRAUD AND A DISASTER OF THE BRAIN OF NARENDRA MODI

1.Even the RBI initally accepted the disaster – but later went along like all lackeys and Indian weasels.as under: The minutes of the RBI Board Meeting which took place just a few hours BEFORE the execution of the DEMO DRIVE stated as under:

• “It (demonetisation) is a commendable measure but will have short-term negative effect on GDP for the current year,” read the minutes of the RBI board meeting.

• “Most of the black money is held not in the form of cash but in the form of real sector assets such as gold or real estate and that this move would not have a material impact on those assets,” the board observed in its 561st meeting held in Delhi.dindooohindoo

2.THERE HAS BEEN NO IMPACT OF DEMO ON SO CALLED TERROR IN INDIA AS THE NUMBER OF THESE ATTACKS AND THE CASUALTIES OF INDIAN SOLDIERS AND CIVILIANS HAS INCREASED AFTER THE DEMO DRIVE

3.THERE HAS BEEN NO IMPACT OF DEMO ON SO CALLED DRUG TRADE IN INDIA AS THE NUMBER OF THESE SEIZURES AND THE HAS INCREASED AFTER THE DEMO DRIVE

4.AS PER THE RBI REPORTS THE COUNTERFEIT CURRENCIES OF RS 50 AND RS 100 NOTES HAS INCREASED BY 50% AS THE COUNTERFEITERS HAVE FOCUSED THEIR TECHNOLOGY ON THESE NOTES.THAT IT BECAUSE THE COUNTERFEITERS ARE TAKING TIME TO PERFECT THE COUNTERFEITING OF THE RS 500 AND RS 2000 NOTES AND ITS SUPPLY CHAIN OF PRINTING, DISTRIBUTION, STOCKING AND DISSEMINATION

5.THE GOI/RBI STATISTICS ON COUNTERFEIT RS 500 AND RS 2000 ARE MISLEADING.THESE NOTES ARE NOT COMING INTO THE BANKING SYSTEM AT THE SAME FREQUENCY AS IN 2017.IF THE NOTES DO NOT COME INTO THE BANKS THE FAKES ARE NOT DETECTED.THEREFORE THE RBI STATISTIC IS FALSE AND MISLEADING

6.AS PER RBI REPORTS,THE FLOWS OF RS 2000 NOTES INTO THE BANKS HAS REDUCED OVER THE YEARS AND BANKS ARE DOLING OUT LESS AND LESS RS 2000 NOTES.THAT MEANS THE RS 2000 NOTES ARE BEING WAREHOUSED BY THE MARKET – FOR MONEY LAUNDERING AND BLACK MARKETING.THAT DEFEATS THE PURPOSE OF DEMO AND MAKES THE CASE FOR DEMO – PART 2 FOR THE RS 2000 NOTES

7.THE ABOVE PROVES THAT THE ENTIRE DEMO DRIVE WAS BOGUS AND NOT BECAUSE ALL THE CASH CAME BACK INTO THE SYSTEM.IT IS BECAUSE ALL THE AIMS FAILED (AS ABOVE)

8.AS PER THE RBI REPORT,RS 11000 CRORES OF CASH DID NOT COME INTO THE BANKING SYSTEM. HOWEVER , THAT IS ALSO A MISLEADING STATISTIC AS

• THE RBI HAS SPENT RS 10000 CRORES IN THE LAST 3 YEARS TO PRINT THE NEW NOTES

• COULD RS 11000 CRORES WHICH IS 0.6% OF THE CASH THAT CAME INTO THE BANKS,REPRESENT THE SOILED,DAMAGED NOTES OR FORGOTTEN CASH OR CASH OUTSIDE INDIAN WHICH COULD NOT RETURN TO INDIA DUE TO THE FEAR OF QUESTIONING AND PROSECUTION – BUT IS LEGIT MONEY ? THAT WOULD BE A CASE OF THE INDIAN STATE CHEATING ITS CITIZENS

o THIS RS 11OOO CRORES IS NOT COUNTERFEIT AS IT IS ASSUMED THAT THESE ARE SERIALLY NUMBERED NOTES

• HAS RBI ACCOUNTED FOR EACH LEGIT CODE NUMBERED CURRENCY NOTE WHILE CALCULATING THE RS 11 CRORES AMOUNT OR IS IT BASED ON A DEDUCTIVE FIGURE ? DEDUCTIVE FIGURES ARE BASED ON ASSUMPTIONS OF COUNTERFEITS AND DAMAGED NOTES.

9.THE RBI REPORT DOES NOT STATE THE VALUE OF THE COUNTERFEIT CURRENCY EXCHANGED FOR GOOD NOTES IN THE DEMO DRIVE.THAT IS A PURE LOSS OF THE DEMO DRIVE AND WAS A FOOL PROOF MODE OF CONVERTING CURRENCY AT POST OFFICES,COOPERATIVES AND BANKS IN TIER 2 AND 3 CITIES

10.IT MUST BE NOTED THAT IF COUNTERFEIT CURRENCY IS SENT INTO INDIA BY A STATE ACTOR,THEN IT IS ONLY REASONABLE TO ASSUME THAT THE SAME HAS ALREADY BEGUN AND IS MORE PROFITABLE THAN BEFORE.

• THE RBI HAS NOT RELEASED THE STATISTICS FOR THE NEW NOTES BEING COUNTERFEITED.

• EVEN IF THE CASES ARE LESS IT WOULD BE SUBJECT TO PARA 10.5 ABOVE.

• ALSO,A COUNTERFEIT IS COUNTED BY THE RBI ONLY IF IT IS DETECTED.GOOD COUNTERFEITS ARE NOT DETECTED.

• AS A MATTER OF RECORD,PAKISTAN’S MINT PRINTS CURRENCIES FOR SEVERAL NATIONS INCLUDING GCC NATIONS,WITH FAR MORE STRINGENT QUALITY NORMS AND SEVERE SAFETY AND RISK FEATURES THAN THE INDIAN RUPEE.

11.IT IS A MATTER OF RECORD THAT THE SMEs HAVE BEEN DESTROYED BY DEMO AND GST AND THEIR OUTPUT HAS BEEN TAKEN OVER BY LARGE CORPORATES – AND THAT IS WHY THE GST AND POWER DEMAND IS HIGHER THAN BEFORE.BUT 100s OF MILLIONS OF LABOUR ARE UNEMPLOYED AND SMEs ARE DESTROYED FOREVER.

12.IN LIGHT OF ALL OF THE ABOVE,WHAT IS THE BENEFIT OF THE DEMO DRIVE ? WAS THERE A SINGLE BENEFIT TO THE NATION ?

13.BESIDES THE ABOVE ,THE DEMO FRAUD AND THE DEMO C OUNTERFEIT FRAUD ( WHEREIN THE COUNTERFEITS ARE EXCHANGED FOR REAL CURRENCY) – IS NOT STATED IN THE RBI REPORT

• THERE IS NO REPORT IN THE MEDIA, OF ANY RECOVERY MADE FROM THE CONVERTERS BY THE DRI/ED

14.HAS THE RBI DATA ON DEMO BEEN AUDITED BY A 3 RD PARTY ? HAS THE RS 15 LAC CRORES OF NOTES BEEN CHECKED FOR EACH CODE NUMBER AND WATERMARK AND COUNTERFEIT ?

• IF NOT,THEN THE NOTES MAY INCLUDE COUNTERFEITS.

o IF YES,THEN THE ESTIMATED COUNTERFEIT AS SAY 3% OF THE AGGREGATE CASH IN INDIA – WOULD BE A BENEFIT – WHICH THE RBI HAS NOT HIGHLIGHTED IN THE REPORT.DOES THAT MEAN THAT THE COUNTERFEITS ARE IN THE NOTES SUBMITTED AND EACH NOTE HAS NOT BEEN VERIFIED.dindooohindoo