Happy New Year to all of you and I trust that you had a relaxing time with your loved ones. We are still in a pandemic and cases are rising all over the world. So please do take care of yourself and your loved ones, wear a mask, and follow social distancing guidelines. And if you are able to, please be generous towards those who are experiencing economic hardships during this pandemic.

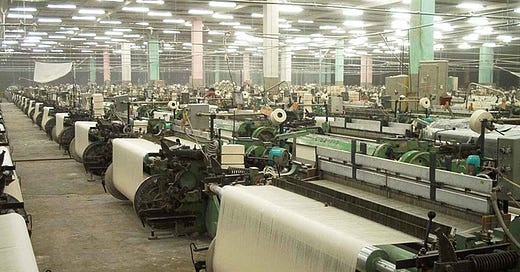

When Western economies went under lockdown in early 2020, policymakers across South Asia became extremely concerned about what was around the corner. This was expected, given that Europe and the United States are the largest export markets for Bangladesh, India, and Pakistan. And as coronavirus cases climbed across the subcontinent, policymakers had to lockdown the economy. From Karachi to Dhaka, factories shuttered, workers were laid off, and the outlook for the year was bleak.

In Pakistan, the lockdown v. no lockdown debate reached a fever pitch, with Imran Khan publicly arguing about keeping the economy open; in India, the Modi government announced a strict lockdown just hours before it was enforced; and in Bangladesh the government opted to shutter factories but started opening things up a few weeks later.

Compared to India and Bangladesh, Pakistan was able to reopen its economy at a faster clip, primarily due to the fact that the case count did not rise anywhere close to the worst-case scenarios. This meant that factories were able to start production again.

Additionally, the government and the State Bank of Pakistan rolled out a series of stimulus measures to support the economic recovery. This included the expansion of cash transfer under the Ehsaas Program, which is the successor of the Benazir Income Support Program (the expansion and evolution of this program across three governments represents a positive development in Pakistani politics).

The results of the federal and provincial governments’ success in controlling the first wave of the pandemic and a coordinated and timely set of stimulus measures are now visible in export data.

I compared Pakistan’s exports with India and Bangladesh and found that Pakistan had the fastest export recovery in the subcontinent.

It is true that Pakistan’s exports had a low base and that underlying structural issues with export competitiveness remain; you can read about these in this post. But the fact that Pakistan was able to reopen its economy and gain a share of export orders that were not being filled due to lockdowns in other economies is something worth celebrating.

Now the test will be whether exporters can maintain these relationships and sustain these gains. The next 6-9 months will be crucial. If Pakistan can deal with some of the structural issues plaguing its economy, exports will continue to grow strongly.

2021 represents an opportunity to maintain this momentum and one hopes that necessary reforms are pushed through that improve the global competitiveness of Pakistani exporters.

The export strategy of Pakistan,should be based on export of water,labour,earth,defense and LDC benefits.Any other model will fail,as competitive nations,with deep pockets,will offer financial,fiscal and asset subsidies,to offset any advantage,that Pakistan,has w.r.t labour cost and geography (besides excellent logistics,and regulatory structures). dindooo hindoo

Setting up manufacturing capacities,to cater to the local Pakistani market and exporting the surplus,is not viable,as Pakistan does not have economies of scale (even to realise the geometric impact,of lower labour costs).Planning capacities on that model,leads to the DISASTER of the Indian NPAs,of 350-400 Billion USD,with exports dead,and the inability of Indians,to compete,with the PRC.

Export of Water – is export of animal proteins,exotic fruits and vegetables and agri to the GCC,EU and other parts of the world.Water from the skies or the earth,by rarefaction or condensation or precipitation,in the form of hail,rain or snow,is purely a function of geography, in a time span of a few decades.Over a period of 3-4000 years,some disasters can occur,like the disappearance of Saraswati (in Pakistan) or the diversion of rivers etc.

Thus,water captures the fertility and agro-ecoonomic opportunities and variety of Pakistani soil,and also,the geo-strategic location of Pakistan (w.r.t access to GCC,Ports,Cheapest Point of Purchase for UN/FAO/WHO procurements for Afghanistan etc.)

In Pakistan,Water is a Perpetual Resource,UNLIKE in India.In addition,many nations in the EU allow a COO certificate linked to a Geography,in that exporting nation, to give ADDITIONAL DUTY/SUBSIDY AND QUOTA BENEFITS. These are agriculture and agri-derivatives,like wine.Pakistan is the prime candidate, for the same,for exotic fruits etc., which have valuable and critical,downstream applications,in the EU.

Export of Earth – is export of minerals,which ALSO,includes industries like Cement (which is export of lime,limestone and coal).Once the Coal Fields of Pakistan,are tapped,then it would include sale of power,as the cheapest way to transport power,is at the speed of light,via a grid – especially,when the Grid is set up by other nations.

Pakistani Mineral Resources are almost perpetual,and in areas with very low density of population and ample water.Thus the scope for TOLERATING pollution is higher – and so,like in Nuke Power – if some latitude is granted w.r.t pollution,wastes,effluents,safety and environment – mining costs can crash exponentially.For a Perpetual reserve,with an exchange rate of Rs 160/USD,it is akin to burying US Dollars, 1000 meters in the earth,and starving on top of the earth.For a nation,with finite reserves (in the short term),there is an opportunity cost,of exports – in terms of the fact that,in 2023 (say),prices of several ores might be 2-5 times,current rates – and so,they can raise USD,from bankers,liening the mining reserves.

Export of Defense – In conjunction with the PRC and the PLA/PLN.PLAF,Pakistan can perfect the technique of customising and innovating Chinese Defense Technology,for their use,and exporting lower technologies or the excess capacities to Africa,Central Asia,LATAM,South America and the Middle East (excluding the quasi Nato nations).With Chines=se Financial Aid, extensive credits can be given.There are many nations in the world,which the PRC would NOT like to make defense exports to.

Export of Labour – Pakistan needs to be practical,to use low cost manufacturing technologies,which are labour intensive and require moderate power consumption,and some pollutive impact.Low Capital Costs,will lower the Operating and Financial Risk,and the skilled but CHEAPER labour cost,can be exported OUT.There would be several such technologies,several products and several markets.

LDC – Lastly,Pakistan has to maximise the LDC benefits,using Chinese Capital and SEZs – with an appropriate mix of Chinese Labour and Domestic Input Costs,in the SEZ units, so that the COO is Pakistan,and the LDC benefits are availed of.

SEZs – The SEZ policy of Pakistan has to be synthesised with the LDC gains,to ensure that the costs to the SEZ,are the lowest among all LDCs in the world.However,the Costs are not to be evaluated,as the Nominal Costs.So the land lease and other charges, payable by the SEZ to the Pakistani State, might not be the lowest – but on a NET differential Mode,w.r.t the Reduction in Logistics costs,to the Pakistani SEZ,it should be the LOWEST in the world. Once that is done,then as a thumb rule, to keep the laws simple, FREE EXIM needs to allowed and all Inputs (including Power etc.) should be sourcable,w/o caveats.So a SEZ should be able to set up a IPP/CPP/RPP,anywhere in Pakistan,with any fuel,with nil duty and taxes and the lowest wheeling and banking charges. dindooohindoo

Corporate Tax holidays should start AT THE CHOICE of the Investor,FROM THE YEAR after which the Brought forward losses,of the SEZ are exhausted.And the Tax holiday should be co-terminus,with that of the longest holiday,by any LDC.The period of limitation, for the Choice of initiating the holiday period,should be upto 5 years,from commercial operations.

Basically,even if Pakistan waives the Wheeling charges etc.,it does not matter,as the aim is to bring in the ANCHOR and other Investors in the SEZ. Thereafter,the principles of Self Preservation by the SEZs,and its units,will ensure that,the State will find ingenious ways to earn revenue – provided that,1st the ANCHOR comes in,and then, that the SEZ and the SEZ units,make money !